Australian Government launches online register of small business payment times

How to stay compliant, accountable and protect your business reputation. A new age of public accountability for procurement compliance and payment...

If the annual income of your business totals more than $100 million then it’s time to acquaint yourself with the new PTRS (Payment Times Reporting Scheme) legislation. The New Year is traditionally a time to nurse sore heads, reflect on the successes and setbacks of the year that was and start putting those New Year’s resolutions to work. If you’re a C-Suite executive in Australia, it’s also a time to begin preparing for the new Payment Times Reporting Scheme (PTRS), which will commence from 1 January 2021.

The Payment Times Reporting Act 2020 was passed by Australian Parliament in October 2020 and requires Constitutionally Covered Entities(CCEs) that make more than $100 million per annum in income – or entities that have an income greater than $10 million per annum if the entity is part of a group with a combined total income of greater than $100 million per annum – to submit a report on their small and medium business (SME) payment terms and practices every six months. Failure to report accurately and on time can result in a number of serious financial penalties.

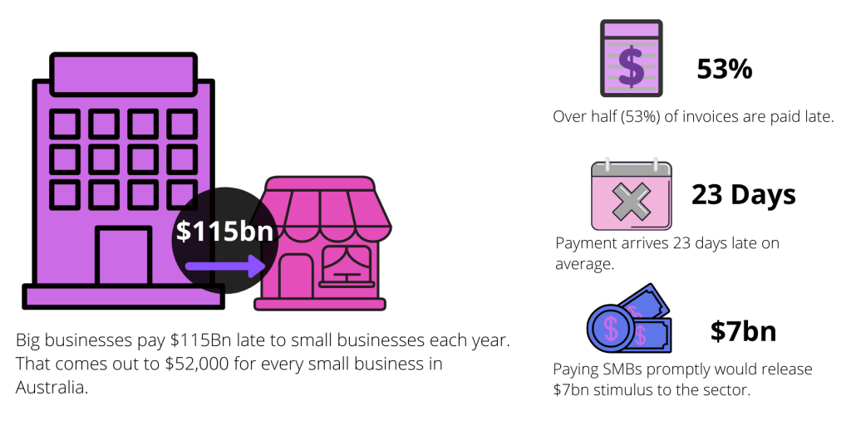

It’s long been acknowledged that cash flow issues kill SMEs with some sources estimating 30% of all small business ventures fail due to low liquidity. Following the impact of COVID, we’ve experienced a volatile economy and supporting small business is more crucial now than ever before. While the root causes for poor cash flow can be many and varied, late payments from clients are certainly a factor, tipping businesses whose financial fortunes hang in the balance over the edge and harming their ability to hire, invest and grow.

According to the Australian Small Business and Family Enterprise Ombudsman (ASBFEO), 53 percent of invoices are paid late, and on average are overdue by 23 days. This equates to $115 billion paid late each year, an impact of $52,000 for every small business in Australia.

When it comes to implementation, there’s two questions that will likely determine how challenging the process will be for your company: 1. do you have visibility of small and medium businesses in your supply chain? 2. Do your payment contract terms with these suppliers comply with the new legislation?

Once CCEs have identified their SMEs and associated contract payment terms, they are also required to compile a report every 6 months that categorises invoices and their values into the timeframes within which they were paid, as well as the proportion (by value) of procurement from small business suppliers.

Beyond the manpower required, the other challenge many commercial enterprises face is the lack of integration between departments. There’s often little crossover between accounts and procurement teams, which has the potential to make reporting difficult, as PTRS guidance states that CCEs must detail the date of receipt of an invoice – information that typically only accounts would know.

Other potential issues include keeping up to date with the ever-evolving nature of government legislation: it is the legal responsibility of reporting entities to ensure they are complying with the latest regulatory requirements.

Several penalties await businesses that fail to adhere to the PTRS rules, from failing to report to failing to keep records, or providing false or misleading reports.

Those who fail to report can be slapped with financial penalties and those who produce a false or misleading report can be fined up to 0.6% of their annual turnover. Businesses that fail to keep records can be fined up to 0.2% of their annual turnover and there are further financial penalties for reporting entities that fail to comply with an audit notice or assist the auditor.

But the penalty of non-compliance can cause much more insidious long-term damage to your public image. CCEs that fail to abide by the new rules will risk being named and shamed by the regulator on a register on the Payment Times website, which will be freely available to the public.

Sifting through all your company’s data to uncover exactly who your small business suppliers are is a task that’s both time-consuming and prone to human error. If your accounts and procurement teams are already overwhelmed, without capacity to navigate through this new legislation, then it might be time to consider partnering with an expert to solve this problem.

Because of the rapid evolution of AI software, machine learning can take away the logistical burden that the new PTRS ruling places on CCEs. With a few clicks RobobAI can identify the SMEs in your supply chain, generate a report at the end of the reporting period, and analyse your supplier payment pattern. This translates to fewer overdue invoices in your system, a broader overview of your accounts payable at any given time, the removal of guesswork, stress-free biannual reporting that require little input from you or your company, to ensure you are meeting the reporting requirements on time, and, as such, averts the risk of facing penalties enforced by the regulator.

How to stay compliant, accountable and protect your business reputation. A new age of public accountability for procurement compliance and payment...

Under the Modern Slavery Act 2018, large businesses and other entities in the Australian market need to submit annual Modern Slavery Statements to...